Unit Trusts

Take the complexity out of investing

Unit Trusts are professionally managed funds that allow you to invest in financial markets, together with other investors, through a management company. Minimum opening balance of N$75 000.

FNB Namibia Unit Trusts

Anyone can invest with FNB

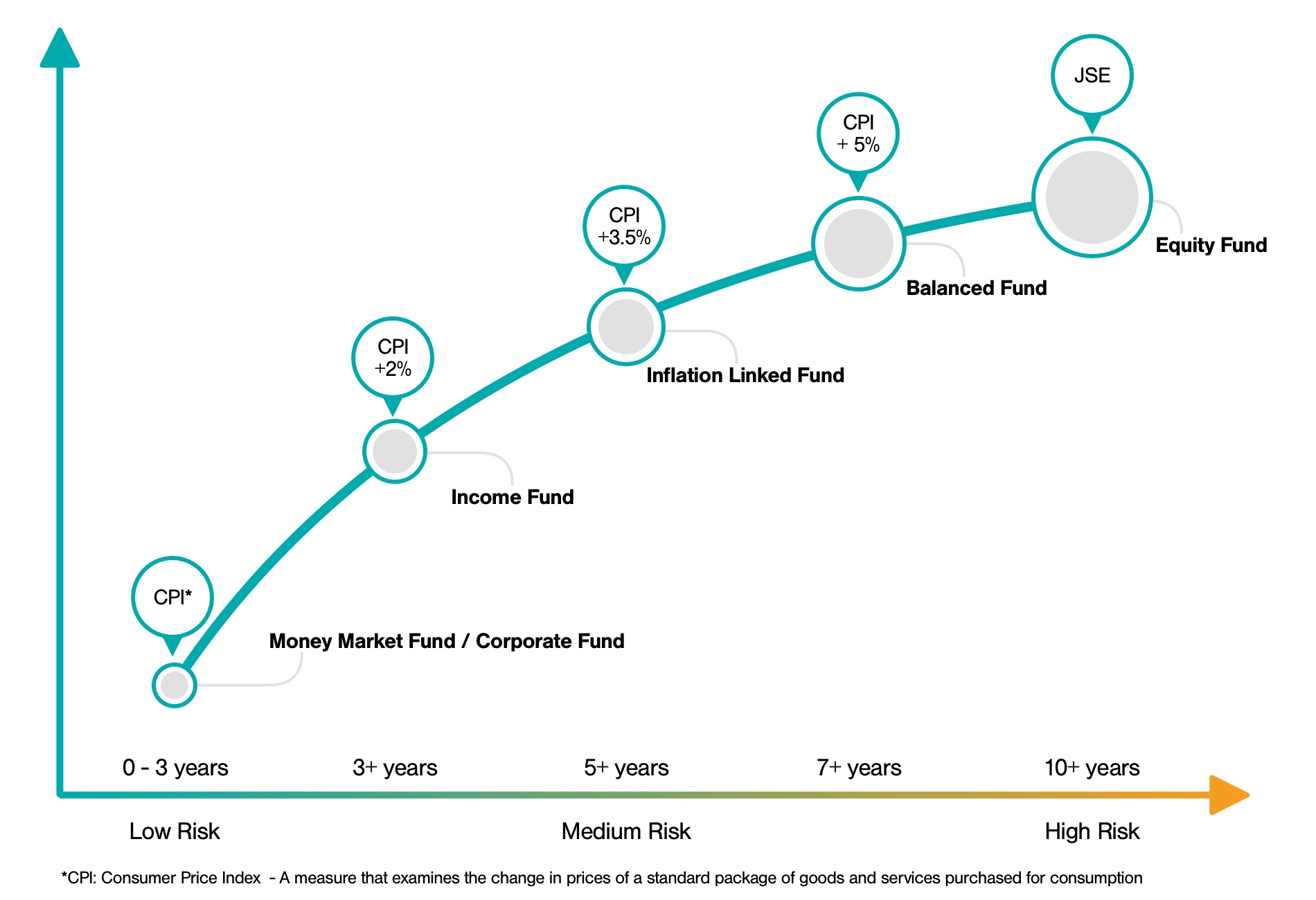

Our FNB Namibia Unit Trusts is a range of four expertly modeled funds, which have been built to ensure that

investors derive the maximum level of benefit based on their specific investment period.

FNB has worked in close partnership with investment specialists across FirstRand Bank to ensure that

we bring you a simple but superior investment range.

How to fund

Manage your funds professionally

Greater buying power

Funds are pooled together, giving you and other investors greater buying power.

Scheduled monthly payments

Minimum scheduled payment N$500 per month or an opening deposit of N$75 000

Make ad hoc payments

The option to make ad hoc payments electronically into the Unit Trust account.

Use existing account

You only need to have a FNB transactional account for the monthly schedule payments investment.

What's hot

Affordable + flexible investments

Diversify your portfolio

A good way to diversify your investment portfolio.

Build your wealth

Your funds will be invested in a combination of securities, stocks and liquid assets.

Getting it made easy